Office rental market shows positive trends

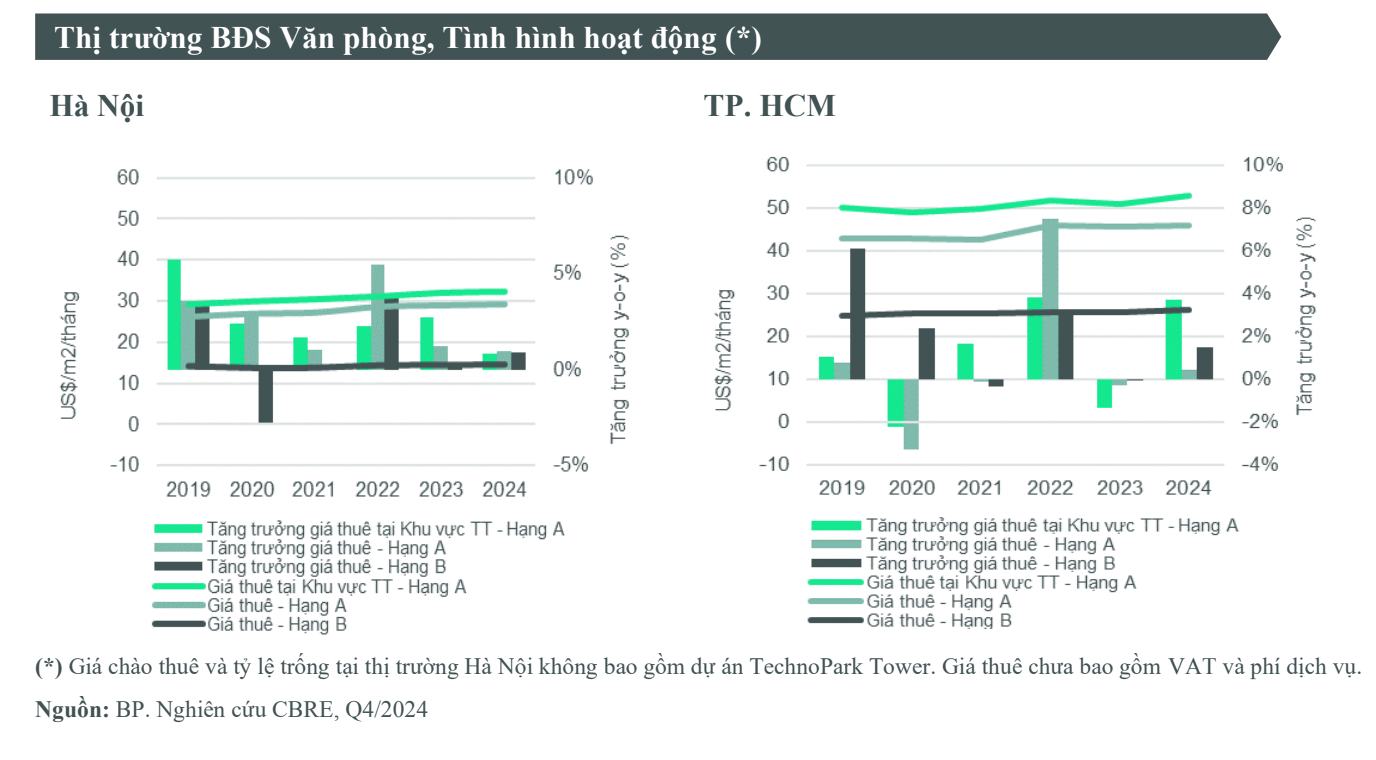

09/01/2025According to CBRE, office rental prices in Hanoi saw a modest increase of nearly 1% compared to 2023, while Ho Chi Minh City (HCMC) recorded a more robust growth of 3.7%.

CBRE’s latest market report highlights that throughout 2024, the office markets in both Hanoi and HCMC experienced improved absorption rates, marking a slight uptick over the past five years.

Rising Rents and Occupancy Rates

Rising Rents and Occupancy Rates

In Hanoi, the office market saw stronger absorption in Grade B properties, with 44,635 m² leased compared to 22,760 m² for Grade A. This positive trend in Grade B absorption is largely attributed to favorable leasing policies offered by buildings in this segment.

In contrast, HCMC’s market showed significantly higher demand for Grade A offices, with 38,000 m² leased compared to 14,613 m² for Grade B. However, Hanoi’s Grade A vacancy rate rose from 20.7% in 2023 to 24.4% in 2024, driven by new office buildings in the Ba Dinh–Dong Da and western areas.

CBRE predicts that in 2025, Hanoi’s office market will see increased leasing activity from large corporations moving to higher-quality buildings, which is expected to improve the city’s occupancy rates. For Grade B offices, vacancy rates improved, dropping 1.8 percentage points to 15.7%. Meanwhile, HCMC’s Grade A segment performed strongly, with vacancy rates falling to 17.6% in 2024, while Grade B vacancies remained steady at 11.0%.

Although Hanoi’s office market remains more cost-sensitive than HCMC’s, recent trends indicate a shift toward leasing higher-quality buildings, mirroring the pattern observed in HCMC.

Focus on Green Certifications

CBRE notes that this trend is not limited to newly completed office buildings in Hanoi. Existing buildings are also adapting by undergoing renovations and pursuing green certifications in recent years. This reflects a commitment to sustainability to meet the evolving standards of tenants in Hanoi’s market.

In HCMC, all new Grade A buildings completed since 2019 have achieved green certifications such as Green Mark and LEED. These high-quality buildings have successfully attracted reputable businesses, leasing spaces ranging from 1,000 to 2,000 m², and in some cases, nearly 10,000 m².

Another notable trend is the growth of the technology and information sector, which accounted for 30% of leased office space in HCMC and 24% in Hanoi. The finance, banking, and insurance sectors followed as the second-largest contributors.

Ms. Pham Ngoc Thien Thanh, Head of Research and Consulting at CBRE in HCMC, commented: “Vietnam is gradually emerging as a hub for technological innovation and flexibility, driven by a dynamic economy and a young, skilled workforce. Businesses are making swift decisions to expand, and they no longer require offices in central city locations. However, building owners must innovate their office spaces to align with the modern working styles of younger workforces.”

Rental Price Growth and Future Outlook

Hanoi’s rental prices across both segments saw a slight increase of nearly 1% compared to 2023. In HCMC, rental prices in the city center rose by 3.7% in 2024, the highest growth across all segments, largely driven by the gradual occupancy of new buildings.

CBRE forecasts that over the next three years, future supply is expected to reach nearly 170,000 m² in Hanoi and over 100,000 m² in HCMC. By 2030, these figures could climb to over 600,000 m² in Hanoi and more than 300,000 m² in HCMC, provided projects receive timely permits.

The trend of leasing higher-quality offices is expected to drive large enterprises to relocate to better buildings. This shift is projected to stabilize vacancy rates, with Hanoi’s expected to gradually decline to around 16% and HCMC’s to below 10%.

Source: diendandoanhnghiep.vn